Zero-rated vs GST charges for Container Haulage Services

Like all services in Singapore, container haulage services are also subject to Goods & Services Tax. However, did you know that certain items in your invoices are zero-rated?

What is GST?

Also known as Value Added Tax (VAT) in many other countries, Goods and Services Tax (GST) is a consumption tax that is levied on the supply of goods and services in Singapore and the import of goods into Singapore. GST is an indirect tax, expressed as a percentage (currently 7%) applied to the selling price of goods and services provided by GST registered business entities in Singapore.

GST tax is charged to the end consumer therefore GST normally does not become a cost to the company. Businesses merely act as collecting agents on behalf of Singapore tax department.

What kind of goods and services are subjected to GST?

GST is charged on taxable supplies. A taxable supply, is a supply of goods or services made in Singapore, other than an exempt supply. A taxable supply can either be a standard-rated (currently 7%) or zero-rated supply.

Most local sales of goods and provision of local services in Singapore are standard-rated supplies.

Types of Supplies in Singapore

- Standard-Rated Supplies (prevailing GST rates)

- Most local sales of goods and services fall under this category.

- Zero-Rated Supplies (0% GST)

- Export of goods and services that are classified as international services.

- Exempt Supplies (GST is not applicable)

- Sale and rental of unfurnished residential property

- Importation and local supply of investment precious metals

- Financial services

- Out-of-Scope Supplies (GST is not applicable)

- Sale where goods are delivered from overseas to another place overseas

- Private transactions

* A 2% rate hike from 7% to 9% is planned to be introduced sometime between 2021 and 2025, depending on Singapore’s economy, government spending and revenue from other taxes. As of 1 January 2023, GST rate is 8%.

I provide haulage services in Singapore. What does GST mean to me?

GST is only charged by GST-registered businesses. A business must register for GST if its annual turnover exceeds S$1 million.

If you are a GST-registered company, you are required to collect GST from your customers for the goods and services rendered by you and then pay the tax collected to tax authorities.

For example, if you charged S$100 for your services to a customer in Singapore, you must invoice your customer S$100 for your service plus the prevailing GST rates. This invoiced GST amount collected on behalf of the tax authorities from the customer must subsequently be paid to the Singapore tax department on a quarterly basis via GST tax filing.

For small businesses that do meet the requirements, GST registration is optional. Unregistered businesses neither have to collect GST nor remit it to the government.

Likewise, non–GST registered businesses are not allowed to charge GST. It is an offence to charge and collect GST if you are not a GST registered businesses.

I require Container Haulage Services. When should I be charged GST?

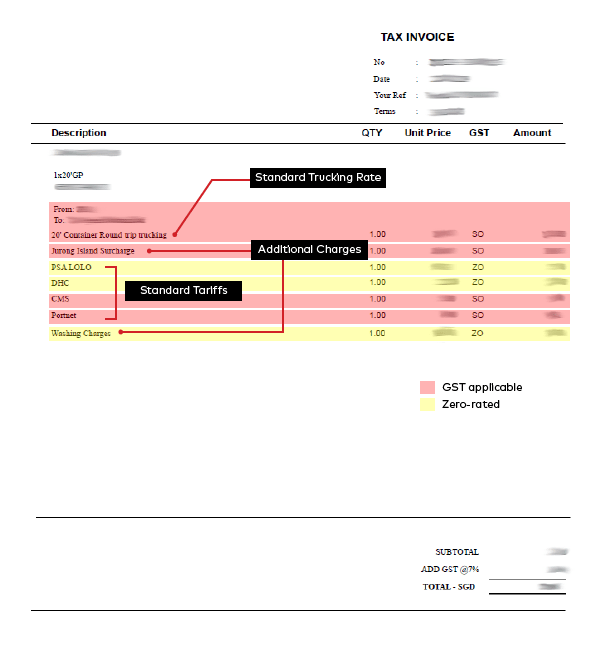

Not all items in a haulage services invoice are applicable for GST. A typical invoice for container haulage services usually includes two types of charges:

- Zero-rated charges

- Standard charges

Understanding the different items in your invoice and whether they are standard or zero-rated supplies will help to ensure that you are making payments for services appropriately.

Zero-rated Services

Recognising that the use of sea and air containers is an essential part of the international transportation of goods, the following supplies made in relation to containers can be zero-rated:

- Sale and lease of qualifying sea and air containers used for international transportation of goods

- Repair, maintenance and management services rendered on qualifying sea and air containers used for international transportation of goods

Below charges are commonly seen in a typical invoice in Singapore. As they would fall under point 2, these charges are thus zero-rated (i.e. GST is charged at 0%):

1. Depot Handling Charge (DHC)

Depot Handling Charge, or DHC for short, is charged by the depot for the handling of containers. Examples of such services provided by depots include:

- Administrative support and handling of containers associated with releasing and receiving of containers to and from customers

- Monitoring and supervising the movements of containers

- Arranging for imports and exports of containers

- Handling imports and export documents on containers

- Securing freight

- Arranging for repair and maintenance of containers

- Ensuring containers are qualified for international travel and carrying intended cargoes

2. Lift-on/Lift-off (LOLO) Charge

- Lift-on/Lift-off charges, commonly known as LOLO, are charged whenever cargo is lifted on and off a vessel or vehicle.

3. Additional Charges incurred to Maintain Containers

- These charges include washing and repair charges.

Services applicable for GST

Generally, services rendered below are applicable for GST at prevailing rates:

- Trucking Charges

- Charges incurred for the transportation of cargo within Singapore.

- Charges incurred for the transportation of cargo within Singapore.

- Out-of-Jurong Charge (OOJ)

- Charges payable for the transportation of locations not within the Jurong area. These charges are GST-chargeable.

- Charges payable for the transportation of locations not within the Jurong area. These charges are GST-chargeable.

- Tri-axle Charges

- The transportation of containers with high tonnage requires the use of a tri-axle chassis, which will incur a tri-axle charge.

- The transportation of containers with high tonnage requires the use of a tri-axle chassis, which will incur a tri-axle charge.

- Container Management System (CMS) Charges

- In Singapore, container Management System charges, also known as CMS charges, are charged by depots for users to book and arrange for returning or collect of containers

- In Singapore, container Management System charges, also known as CMS charges, are charged by depots for users to book and arrange for returning or collect of containers

- Portnet Charge

- In Singapore, Portnet is a system used to facilitate the submission of various mandatory port documentations.

- Charges are made whenever Portnet is used.

- Diversion/Additional One-way

- If the trucking job requires a change, additional charges will be incurred.

- If the trucking job requires a change, additional charges will be incurred.

- Standby Charges

- These are charges incurred when truck drivers have to wait more than an agreed time for the cargo to be unloaded.

- These are charges incurred when truck drivers have to wait more than an agreed time for the cargo to be unloaded.

- Wrong Weight

- If the cargo is found to have a wrong weight declared, there will be charges incurred

- If the cargo is found to have a wrong weight declared, there will be charges incurred

- Weighing Charges

- In addition to 8), additional charges will also be incurred for reweighing the cargo.

- In addition to 8), additional charges will also be incurred for reweighing the cargo.

- Parking Charges

Conclusion

To summarize, check your invoices carefully and ensure that you are paying for GST appropriately!

Questions?

We’re glad to assist! Fill up the form below and we’ll get back to you shortly.